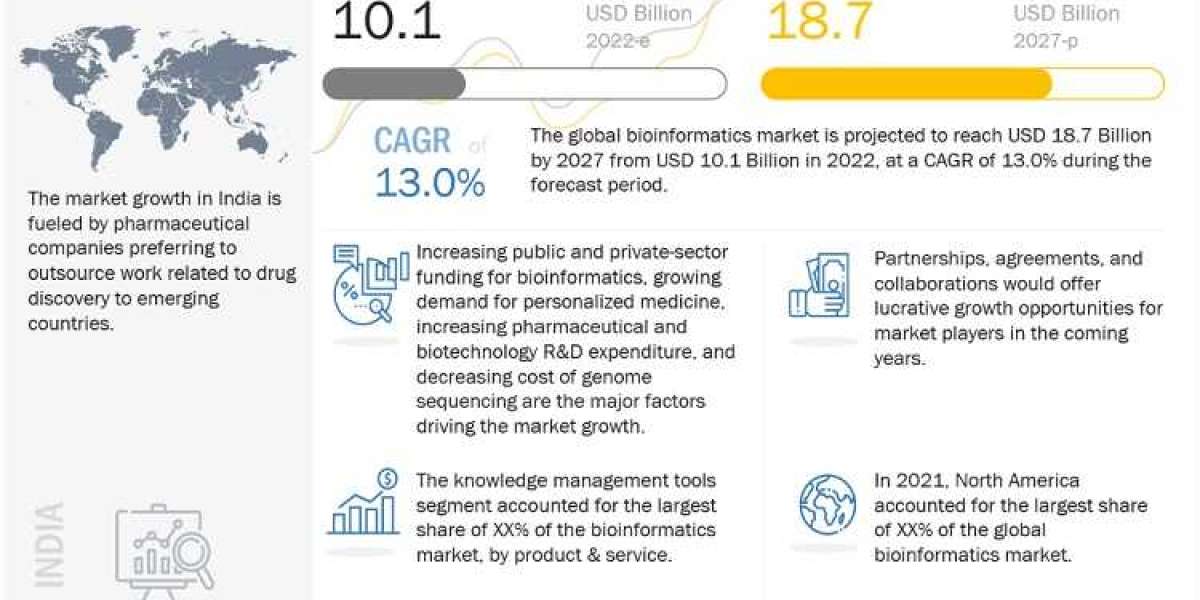

Bioinformatics Market is projected to reach USD 18.7 billion by 2027, at a CAGR of 13.0%. according to a new report by MarketsandMarkets™. The use of computer technology to comprehend and utilise biological and biomedical data effectively is known as bioinformatics. It is the field responsible for storing, analysing, and interpreting the Big Data gathered during clinical settings or as a result of life science investigations. The growth of the bioinformatics market is driven by the increasing public and private-sector funding for bioinformatics, growing demand for personalized medicine, increasing pharmaceutical and biotechnology RD expenditure, and decreasing cost of genome sequencing. However, the high cost of equipment is hindering the growth of this market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=39

Browse in-depth TOC on "Bioinformatics Market"

220 - Tables

36 - Figures

226 – Pages

"Bioinformatics services to register the highest growth in the type market"

Based on products services, the market is segmented into knowledge management services, bioinformatics platform, and bioinformatics services. Government Fundings and private bodies for NGS-based projects, advancement in technology of genome sequencing, decreased sequencing costs, and big data in healthcare are the major factors driving the growth of this market. The knowledge management tools segment accounted for the largest share of 36.3% of the bioinformatics market in 2021. Knowledge management tools are used to manage large volumes of heterogeneous information. It is generally the data from experiments and the data retrieved from available from various secondary sources.

"The genomics segment accounted for the largest share of the bioinformatics market"

Based on application, the market is segmented into genomics, chemoinformatics drug design, proteomics, transcriptomics, metabolomics, and other applications. The genomics segment accounted for the largest share of 36.9% of the bioinformatics market in 2021. The increasing use of genomic research for the development of precision medicine and drug development, the rise in the funding opportunities for genomic research, and growth strategies between various life sciences and informatics companies for the development of advanced bioinformatics solutions and services are the major factors that contribute to the rising values of the bioinformatics market for genomics.

"Medical biotechnology to hold the largest segment of the market"

Based on the sector, the market is segmented into medical biotechnology, animal biotechnology, plant biotechnology, environmental biotechnology, forensic biotechnology, and other sectors. In 2021, the medical biotechnology segment accounted for the largest share of 50.3% of the bioinformatics market. The new databases for drug discovery, the use of bioinformatics solutions for clinical diagnostics, and the rising funds for the development of bioinformatics solutions for drug discovery clinical diagnostics are primarily contributing to the growth of the medical biotechnology segment in the market.

"North American bioinformatics market to dominate the market during the forecast period"

North America dominated the bioinformatics market in 2021 and is expected to grow at an 12.7% CAGR during the forecast period. The North America holds large share in the global bioinformatics market owing to factors such as government support for genomic research, presence of top key players in the region, reduced cost of sequencing, increased awareness of bioinformatics services, and increased number of genomic research activities (and the corresponding adoption of bioinformatics) in the region are driving the growth of the bioinformatics market in North America.

Bioinformatics Market Dynamics:

Drivers:

1. Increasing public-private sector funding for bioinformatics

2. Increasing demand for personalized medicine

3. Increasing pharmaceutical and biotechnology RD expenditure

4. Decreasing costs of genome sequencing

Restraints:

1. High equipment costs

Opportunities:

1. Lucrative opportunities in emerging markets

2. Adoption of blockchain technology and cloud computing

3. Integration of machine learning and AI in healthcare

4. Investments by leading IT companies in the development of bioinformatics solutions

Challenges:

1. Management of large data volumes

2. Lack of interoperability and multiplatform capabilities

3. Growing competition from in-house development and publicly available tools

4. Shortage of skilled bioinformatics professionals

Key Market Players:

Some of the prominent players operating in the bioinformatics market are Thermo Fisher Scientific, Inc. (US), Eurofins Scientific (Luxembourg), QIAGEN N.V. (Netherlands), Agilent Technologies, Inc. (US), and Illumina, Inc. (US), Waters Corporation (US), DNASTAR (US), NeoGenomics Laboratories (US), Perkin Elmer, Inc. (US), GENEWIZ (US) and BGI Group (China), Partek Incorporated (US), SOPHiA Genetics (Switzerland), Source BioScience (UK), and Biomax Informatics AG (Germany) among others.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=39

Recent Developments:

· In October 2022, Illumina, Inc. and AstraZeneca formed a strategic research collaboration to expedite the discovery of therapeutic targets by combining their strengths in AI-based genome interpretation and genomic analysis tools with industry knowledge. The cooperation would assess if a framework made of both these technologies can boost target discovery yield and confidence in order to identify prospective therapeutics based on human omics insights.

· In September 2022, Thermo Fisher Scientific joined the Pennsylvania Biotechnology Center (PABC) as a founding sponsor of both the Philadelphia-based B+Labs incubator and the PABC site in Doylestown, Pennsylvania, where emerging life science enterprises can accelerate their progress to commercialization.

· In January 2021, BGI and the Ministry of Health of Brunei expanded their partnership to carry out extensive cooperation in public health emergency response and public health testing screening and diagnostic services, including reproductive health, personalized drug guidance, early cancer screening, and detection of unknown pathogens by using BGI's cutting-edge sequencing technology.

· In January 2020, Charles River Laboratories, Inc. entered into a partnership with Fios Genomics to gain access to the expertise of Fios Genomics in the field of bioinformatics, statistics, and biology.

Get 10% Free Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=39