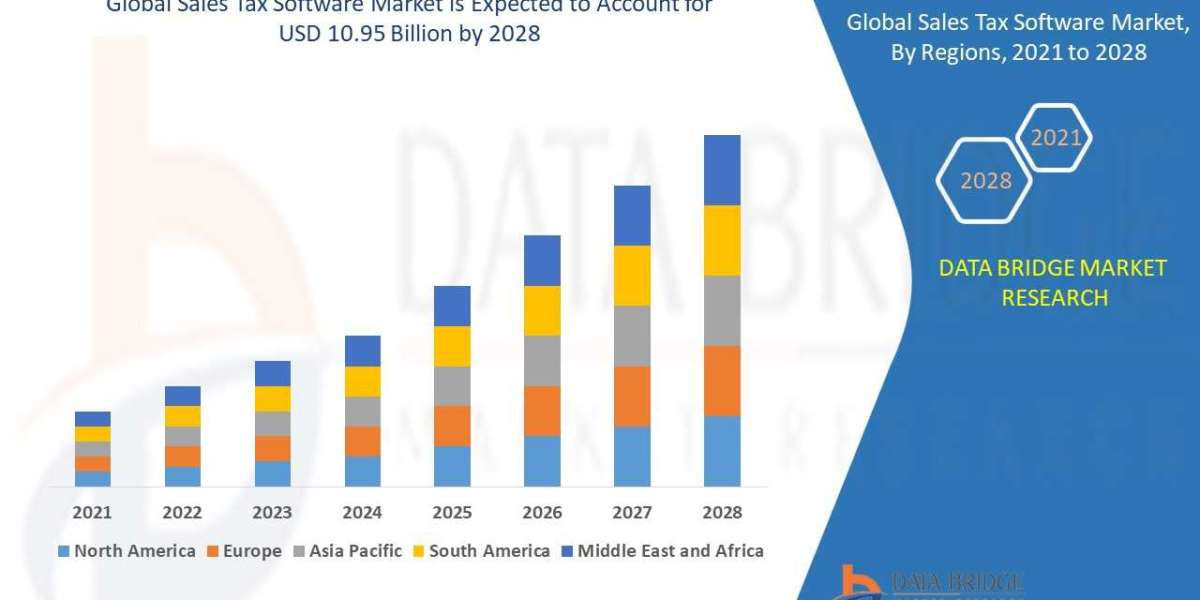

Market Analysis and Insights Sales Tax Software Market

Significant penetration of internet and cloud computing resulting in greater adoption of these services is a crucial factor accelerating the market growth, also increase in the levels of quantities of transactions and the amounts pertaining to these transactions results in complicated process of tax filing, requiring a simplified tax filing service and increase in cross border trade and online retail across the world that are coupled with latest trends which include, e-commerce and digitalization are the major factors among others boosting the sales tax software market. Moreover, rise in the research and development activities in the market and increase in the demand from emerging economies will further create new opportunities for sales tax software market in the forecast period mentioned above.

However, rise in the absence of quality infrastructure required for efficient operations of these services, increase in the requirement of knowledgeable professionals to provide efficient workflow of services and maintaining the operational cycle and increase in the concerns regarding security of confidential data of an enterprise with the deployment of these services over the cloud are the major factors among others restraining the market growth, and will further challenge the sales tax software market in the forecast period mentioned above.

Sales Tax Software Market Scope

The sales tax software market is segmented on the basis of solution, deployment model, industrial vertical, application and end-users. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

· On the basis of solution type, the sales tax software market is segmented into consumer use tax management, automatic tax filings, exemption certificate management and others.

· Based on deployment model, the sales tax software market is segmented into on-premises, cloud-based and SaaS.

· Based on industrial vertical, the sales tax software market is segmented into BFSI, transportation, retail, telecommunication IT, healthcare, manufacturing, food services, energy utilities and others.

· Based on application, the sales tax software market is segmented into small business, midsize enterprise and large enterprise.

· The sales tax software market is also segmented on the basis of end-users into individuals and commercial enterprises.

Get the sample copy of Report here: https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-sales-tax-software-market

Sales Tax Software Market Country Level Analysis

The countries covered in the sales tax software market report are U.S., Canada and Mexico in North America, Brazil, Argentina and Rest of South America as part of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

Competitive Landscape and Sales Tax Software Market Share Analysis

The Sales Tax Software Market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies’ focus related to Sales Tax Software Market.

Key Players Sales Tax Software Market

- APEX Analytix LLC

- Avalara Inc.

- Intuit Inc.

- LumaTax Inc.

- Ryan

- LLC

- Sage Intacct Inc.

- Sales Tax DataLINK

- Sovos Compliance LLC

- Thomson Reuters

- Vertex Inc.

- Zoho Corporation Pvt. Ltd.

- Xero Limited

- The Federal Tax Authority LLC

- d/b/a TaxCloud

- Wolters Kluwer

- CFS Tax Software Inc.

- Service Objects Inc.

- TaxJar

- Chetu Inc.

Get Full Access of Report @

https://www.databridgemarketresearch.com/reports/global-sales-tax-software-market

MAJOR TOC OF THE REPORT

- Chapter One: Introduction

- Chapter Two: Market Segmentation

- Chapter Three: Market Overview

- Chapter Four: Executive Summary

- Chapter Five: Premium Insights

- Chapter Six: Global Sales Tax Software Market by Product Procedure type

Get TOC Details:

https://www.databridgemarketresearch.com/toc/?dbmr=global-sales-tax-software-market

BROWSE RELATED BLOGS

https://www.databridgemarketresearch.com/news/global-sales-tax-software-market

About Us:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market.

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818