Understanding Cryptocurrency

1.1 What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of currency that utilizes cryptography for secure financial transactions. Unlike traditional fiat currencies issued by governments, cryptocurrencies operate independently of central banks. Bitcoin, the first cryptocurrency, was introduced in 2009, and since then, thousands of cryptocurrencies have emerged.

1.2 How Does Cryptocurrency Work?

Cryptocurrencies work on blockchain technology, a decentralized and transparent ledger system. Transactions are verified and recorded on the blockchain by a network of computers called miners. Cryptocurrencies offer advantages like decentralization, privacy, and lower transaction fees compared to traditional financial systems.

1.3 Popular Cryptocurrencies

Some popular cryptocurrencies include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Ripple (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

Exploring Forex Trading

2.1 Introduction to Forex Trading

Forex (foreign exchange) trading involves buying and selling currencies in the global marketplace. It is the largest financial market globally, with trillions of dollars traded daily. Forex trading provides opportunities to profit from the fluctuations in exchange rates between different currency pairs.

2.2 How Does Forex Trading Work?

Forex trading occurs through decentralized electronic platforms, where participants speculate on the price movements of currency pairs. Traders can take long (buy) or short (sell) positions based on their predictions. Currency pairs represent the relative value of one currency against another, such as EUR/USD (Euro/US Dollar) or GBP/JPY (British Pound/Japanese Yen).

2.3 Major Currency Pairs

Major currency pairs in forex trading include:

- EUR/USD

- GBP/USD

- USD/JPY

- USD/CHF

- AUD/USD

Getting Started with Crypto and Forex Trading

3.1 Setting Up a Trading Account

To begin trading crypto or forex, you need to set up a trading account with a reputable brokerage or exchange. Research and choose a platform that offers a user-friendly interface, security features, and a wide range of tradable assets.

3.2 Choosing a Reliable Trading Platform

Ensure that the trading platform you select is regulated by relevant authorities and has a good reputation in the industry. It should offer features like real-time market data, charting tools, order execution options, and customer support.

3.3 Security Measures and Best Practices

Safeguard your trading account by enabling two-factor authentication, using strong passwords, and being cautious of phishing attempts. Regularly update your software and keep your devices protected with antivirus software. Additionally, consider using hardware wallets to store your cryptocurrencies securely.

Fundamental Concepts in Crypto and Forex Trading

4.1 Market Analysis: Fundamental and Technical

Market analysis plays a crucial role in trading decisions. Fundamental analysis involves evaluating economic indicators, news events, and geopolitical factors that impact the value of cryptocurrencies or currencies. Technical analysis, on the other hand, focuses on chart patterns, trends, and indicators to predict future price movements.

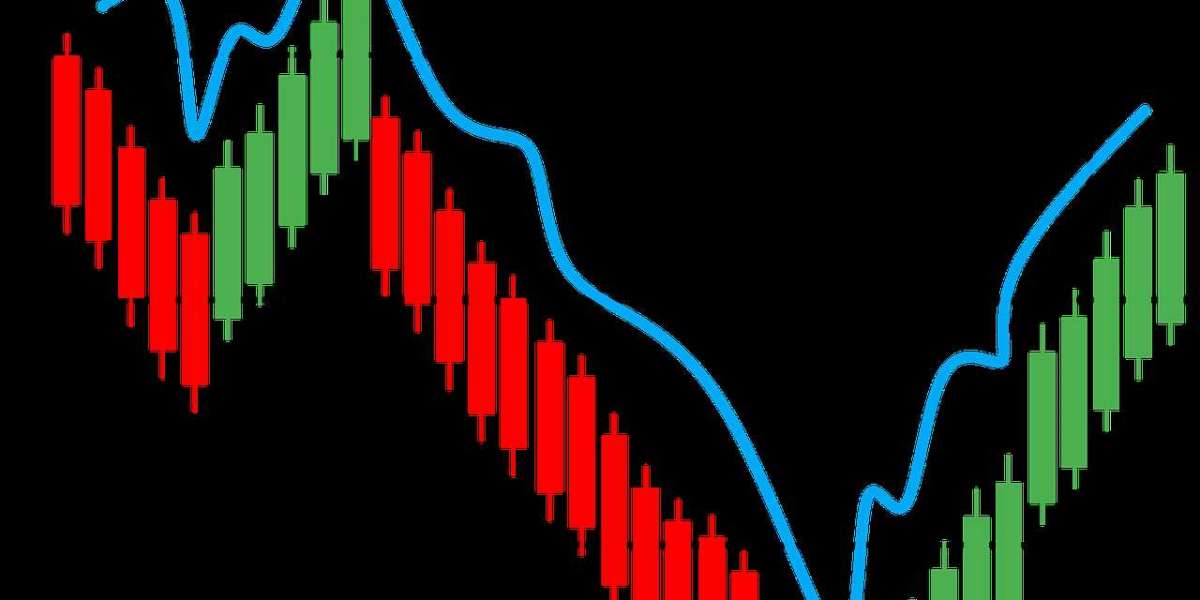

4.2 Reading Candlestick Charts

Candlestick charts are commonly used in technical analysis to visualize price movements. Each candlestick represents a specific time frame and provides information about the opening, closing, high, and low prices. Traders analyze patterns like doji, hammer, and engulfing to identify potential reversals or continuations in the market.

4.3 Order Types and Execution

Understanding different order types is essential for executing trades effectively. Market orders are executed at the current market price, while limit orders allow traders to set specific price levels for entry or exit. Stop-loss orders help minimize potential losses by automatically closing positions if the market moves against the trader's expectations.

Developing a Trading Strategy

5.1 Risk Management

Implementing proper risk management techniques is vital for long-term success in trading. This involves determining the appropriate position size, setting stop-loss levels, and maintaining a risk-reward ratio that aligns with your trading strategy.

5.2 Setting Realistic Goals

Set achievable goals when trading crypto or forex. Focus on consistent profitability rather than aiming for unrealistic gains. Define your risk tolerance and invest only the amount you can afford to lose.

5.3 Choosing the Right Trading Style

Different trading styles suit different individuals. Some traders prefer day trading, while others opt for swing trading or long-term investing. Experiment with different styles and find the one that aligns with your personality, time availability, and risk tolerance.

Tools and Resources for Trading Success

6.1 Trading Indicators

Trading indicators assist traders in making informed decisions. Popular indicators include moving averages, relative strength index (RSI), and Bollinger Bands. Experiment with different indicators to find the ones that complement your trading strategy.

6.2 Economic Calendars

Stay informed about economic news and events that can impact the crypto and forex markets. Economic calendars provide schedules of upcoming announcements, such as interest rate decisions, GDP releases, and employment reports.

6.3 Demo Accounts and Paper Trading

Before risking real money, practice trading strategies and test your skills using demo accounts or paper trading platforms. These tools allow you to trade in a simulated environment without the fear of losing capital.

Common Mistakes to Avoid

7.1 Emotional Trading

Avoid making impulsive trading decisions based on emotions like fear or greed. Develop a disciplined approach and stick to your trading plan.

7.2 Overtrading

Excessive trading can lead to increased transaction costs and emotional exhaustion. Focus on quality trades rather than constantly seeking new opportunities.

7.3 Neglecting Risk Management

Neglecting risk management can result in significant losses. Always prioritize risk management techniques and adhere to them strictly.

Learning from the Experts

8.1 Following Influential Traders and Analysts

Learn from experienced traders and analysts by following their insights on social media platforms, blogs, or educational websites. Engage in discussions and stay updated with market trends.

8.2 Joining Trading Communities and Forums

Join online trading communities and forums to connect with like-minded individuals. These platforms offer opportunities to share ideas, ask questions, and learn from others' experiences.

8.3 Continuous Education and Skill Development

Trading is a lifelong learning process. Stay curious and invest in your knowledge by reading books, attending webinars, and taking courses to enhance your trading skills.

Conclusion

Learning about crypto and trading forex opens up exciting opportunities in the financial markets. By understanding the fundamental concepts, developing a robust trading strategy, and utilizing appropriate tools, you can increase your chances of success. Remember to practice patience, discipline, and risk management throughout your trading journey. Start small, learn from your mistakes, and continually adapt to market conditions to improve your trading skills. To learn more and earn more, visit: Trd Floor.